"Wind Farms Are Overstating Their Output — And Consumers Are Paying For It" – Bloomberg Investigation Reveals

'The energy regulator Ofgem is investigating allegations that some UK wind farms may have inaccurately added nearly £51 million to taxpayer bills since 2018 by overstating their power output'

If you have received this post via my Substack email list please note that it is far too long to be read in your email. As such, please click on the title to read it in full on Substack.

I am grateful to the friend who shared with me the following most interesting information reported by Energy Live News which spurred me to take a deeper look at the allegedly “inaccurate” accounting by UK wind farms.

Ofgem probes wind farms over £51m output

The energy regulator is investigating allegations that some UK wind farms may have inaccurately added nearly £51 million to taxpayer bills since 2018 by overstating their power output

By Dimitris Mavrokefalidis • 5 February 2024 • Energy Live News

Image: ShutterstockEnergy regulator Ofgem has initiated an investigation into claims that certain UK wind farms may have contributed to an overstatement of nearly £51 million in taxpayer bills since 2018.

The investigation follows a Bloomberg report, revealing that some wind farm operators have been exaggerating their electricity generation forecasts.

This practice results in increased payments to these operators when they curtail power output on extremely windy days to prevent grid overload.

The report suggests that, on such occasions, payments are made to wind power operators to generate less electricity, subsequently adding to consumer energy bills.

An Ofgem spokesperson told Energy Live News: “Ofgem is investigating the alleged behaviour and has already asked the Energy System Operator (ESO) to look into this – they are responsible for the day to day running of the electricity grid and monitor the behaviour of energy market participants.

“Ofgem will work closely with the ESO to consider all the facts and if it finds evidence of egregious action or market abuse, enforcement action will follow.

“Ofgem will continue to work to protect market integrity and the best interests of consumers, as demonstrated by the recent cases we have concluded against generators who charged excessive prices behind transmission constraints.”

I recommend listening to this Bloomberg podcast discussion with two of the people who were involved in Bloomberg’s intensive investigation into how industrial wind developers in the UK are gaming the system to make greater profits≥≤;l. after being tipped-off by someone in the industry about the lucrative payments made to wind operators when they are asked to constrain, i.e. switch off wind turbines.

This is the description for the podcast:

The UK is in the midst of a green energy transformation, with more than 40% of its electricity coming from wind power as of December. But wind can be unpredictable and the grid can’t always handle the power wind turbines generate on blustery days — and so to protect the grid, operators sometimes pay wind farms to power off. After Bloomberg’s investigations team received a tip about troubling inaccuracies in the data used to calculate these payments, our reporters went looking for answers. And they found a big problem lurking in the UK’s renewable energy market: some wind farm operators were routinely overestimating their production forecasts, and traders and market experts say that, in effect, they’re getting paid to stop producing power that they wouldn’t have produced anyway.

According to Gavin Finch and Todd Gillespie, the reporters who led this investigation, the price tag for consumers is in the millions of pounds. And with the UK aiming to triple the number of wind turbines in the country by the end of the decade, those costs could increase.

The podcast begins with the very apt and truthful comment that the “ballooning of the country’s wind power capacity is directly related to subsidies from the UK Government.”

The following article published by Bloomberg provides some of the evidence which the Bloomberg investigation team compiled after collecting and reviewing some 30 million UK wind market records from 2018 through June 2023. The data set created from the voluminous records was done in order to compare the wind operators’ daily forecasts of planned energy generation with their actual production.

What they found confirmed that some industrial wind operators are gaming the system to profit even more from constraint payments made to them when wind operators are instructed to constrain their output, i.e. turn off wind turbines so as not to overload the National Grid power generation system.

Such constraint payments are made over and above the Renewables Obligation Certificate (ROC) and Contracts for Difference (CfD) subsidies paid to wind developers and operators.

“The ROC system was designed to encourage the development of electricity from renewables. The scheme came into effect in 2002 in Great Britain and Northern Ireland followed in 2005.” Source

“The purpose of CfD is to incentivise investments in new low-carbon electricity generation in the UK by providing stability and predictability to future revenue streams.” Source

As was stated during the podcast, the annual toll of constraint payments made to wind operators is ”into the billions of pounds. In the worst recent year in 2022, UK bill payers paid about £800m extra.”

We bill payers have been and are being literally swindled by unethical, greedy wind developers and operators. In my lay opinion, this is fraud. Those involved in this must be legally held to account and reparations made to we bill payers, many of whom are being pushed into fuel poverty in the UK.

Please read the Bloomberg article below which includes some of the data collected and analysed by Gavin Finch, Todd Gillespie, Eric Fan, Jason Grotto and Sam Dodge which I have replicated below in full from the archived version.

Dozens of British wind farms run by some of Europe’s largest energy companies have routinely overestimated how much power they’ll produce, adding millions of pounds a year to consumers’ electricity bills, according to market records and interviews with power traders.

These extra costs are linked to a growing problem with Britain’s outdated electricity network: On blustery days, too much wind power risks overloading the system, and the grid operator must respond by paying some firms not to generate. This “curtailment” costs consumers hundreds of millions of pounds each year.

Adding to that expense, some wind farm operators exaggerate how much energy they say they intend to produce, which boosts the payments they receive for turning off, according to nine people — traders, academics and market experts — most of whom agreed to discuss this controversial behavior only on condition of anonymity.

In effect, they said, the grid has paid some wind farms not to generate power that they wouldn’t have produced anyway. [Bold for emphasis mine.]

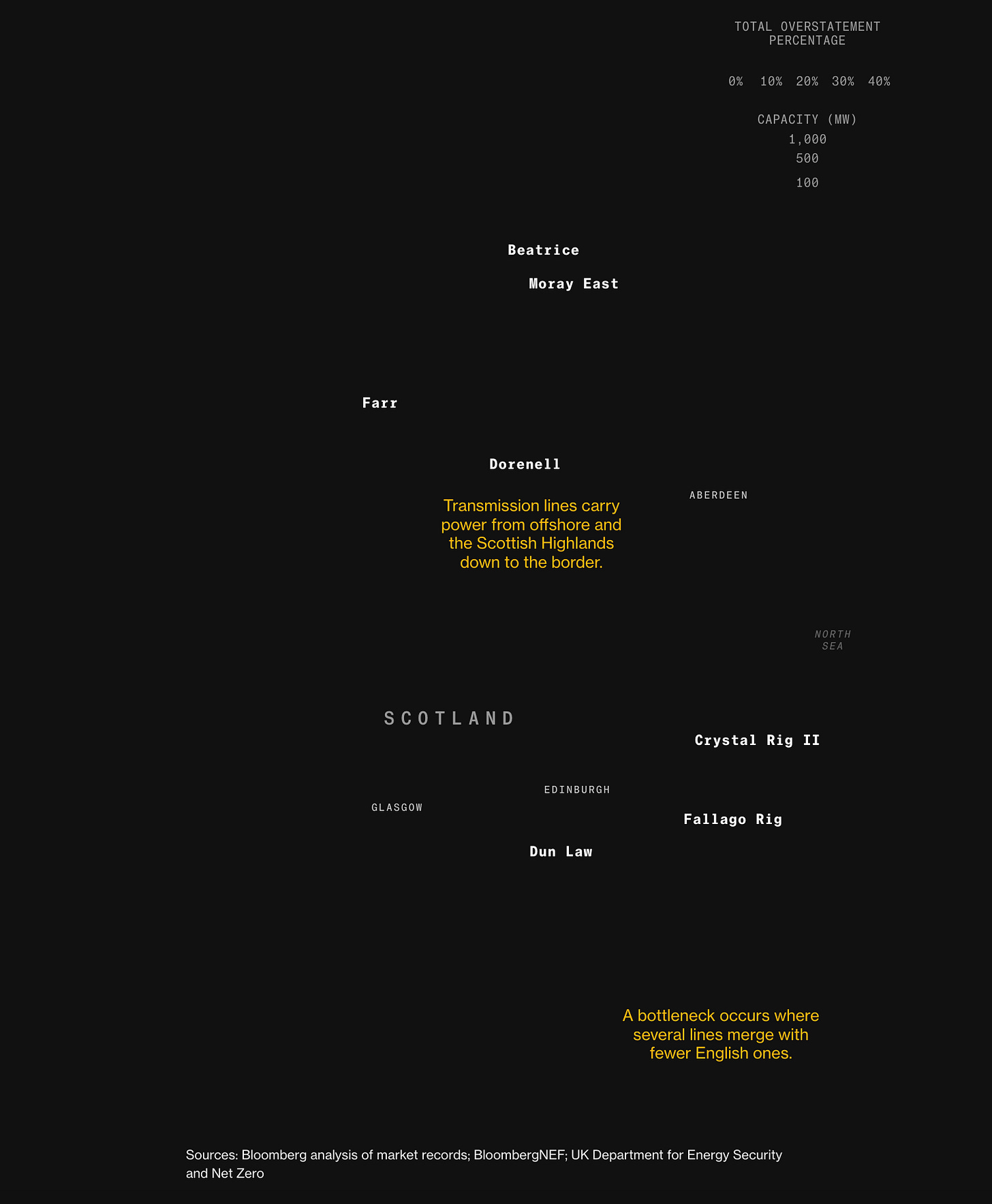

Bloomberg News analyzed 30 million records from 2018 through June 2023 to compare wind operators’ daily forecasts of the energy they planned to generate to their actual production when they weren’t curtailed. Out of 121 wind farms in the analysis, 40 overstated their output by 10% or more on average, and 27 of those overestimated by at least 20%.

Electricite de France SA’s Fallago Rig wind farm near the Scottish border claimed that it would generate 27.1% more power than it did during the five-and-a-half-year period. Just a few miles away, Fred. Olsen Renewables’ Crystal Rig II wind farm said it would produce 35.5% more energy than it delivered. Ventient Energy, backed by JPMorgan Chase & Co.’s asset management arm, overstated the output at its Farr wind farm by 28.7%.

Spokespeople for EDF and Fred. Olsen said in statements that the firms take compliance with market regulations very seriously and work with third-party firms to provide forecasts. Natural Power, a consultant that provides forecasting services to both firms, said it always followed “industry best practice methodology.” Ventient and JPMorgan declined to comment.

It’s impossible to determine precisely how much bill payers have spent due to such overstatements. But assuming a similar rate of overestimation during the times that those 40 farms were paid to stop generating, consumers would have overpaid an estimated £51 million ($65 million) since 2018.

“The average error should be close to zero. They should be underpredicting as often as overpredicting.”

The data analysis by itself does not demonstrate that any individual company purposely exaggerated its output estimates, and wind can be difficult to predict. But forecasting models are increasingly accurate. Indeed, more than half of the wind farms delivered within 5% of what they predicted. What’s more, about a quarter of them understated their output.

“If you are systematically overpredicting by a large margin then that is suspicious,” said Jethro Browell, a senior lecturer at the University of Glasgow and an expert in energy forecasting. “The average error should be close to zero. They should be underpredicting as often as overpredicting.”

Overstatement has declined recently, but it remains significant. Between 2018 and August 2021, the 40 wind farms that overestimated the most did so by 20%, Bloomberg’s analysis found. From September 2021 through June 2023, those same operators overstated by 13%.

UK regulations explicitly prohibit generators from “obtaining an excessive benefit” when they are paid to stop or reduce their output due to grid constraints. Other rules stipulate that firms must submit a “best estimate” of their generation plans and stick to it as closely as possible.

Former UK Energy Secretary Jacob Rees-Mogg said he was shocked by the scale of the overestimation and called on the regulator, which is known as Ofgem, to act urgently. “I’d like to see Ofgem investigate to see if they can verify Bloomberg’s findings,” said Rees-Mogg, who remains a member of Parliament. “If they do, I’d like to see them pass a file to prosecutors to establish whether these firms are committing fraud. The government needs to push Ofgem to act.”

After this story was published on Thursday, an Ofgem spokesman told Bloomberg it had begun “investigating the alleged behavior.” The regulator has also asked National Grid Plc’s network operator to look into the matter, the spokesman said. “We will continue to work to protect market integrity and consumers.”

Any company found to be deliberately submitting inaccurate forecasts would face a substantial fine, Ofgem said in an earlier statement.

One energy trader said that exaggerating forecasts was justified because so many firms are doing it. Those that don’t, he said, would be at a disadvantage. Also, the trader said, estimating output is imprecise, and it’s better financially to err on the side of predicting too much wind.

A senior trader who works at an energy company that rarely gets it wrong had a different perspective. He said there was no legitimate reason why some operators’ forecasts were consistently inaccurate while others weren’t. Some firms are just more aggressive in seeking to maximize revenue from curtailment, he said.

That trader added that it was dishonest to exaggerate intended output in order to extract additional money from hard-pressed consumers. He was dismayed that regulators hadn’t stamped out the practice.

Last winter, as people struggled with the cost of heating their homes amid historic energy inflation, local councils established public “warm rooms.” During that time, a Bloomberg investigation found, energy company maneuvers added hundreds of millions onto consumers’ tabs. Gas plants extracted record prices from Britain’s grid, for example, after threatening to turn off supply at times of peak demand.

Energy markets are vulnerable to such gaming when there’s a risk that supply won’t meet demand, experts say. And as grids around the world increasingly grow dependent on wind and solar power, they’re exposed to greater strain when the sun doesn’t shine and the wind doesn’t blow. But due to limits in its infrastructure, the UK also faces the opposite problem: too much supply.

Thousands of giant white turbines straddle the lush peat-carpeted hills of the Scottish Highlands and Border regions. Given their dimensions — typically taller than Big Ben, with three long blades that rhythmically scythe the air — they are mostly built in remote areas, where land is cheaper and planning restrictions looser. Most are in Scotland, which offers some of the windiest conditions in Europe.

Their output largely flows to population centers in England — but the system often can’t cope with the power surges that occur amid high winds.

This wasn’t much of a problem in 2008, when wind generation accounted for less than 2% of British electricity. But wind power has ballooned — in December it accounted for more than 40% — and the UK has lagged in expanding its grid to handle the extra load.

Each wind farm files daily estimates of the power it plans to generate. When these indicate there will be too much wind power, the network operator intervenes and pays generators in the north to switch off. It’s a policy meant to incentivize energy firms to build wind turbines without having to worry about losing revenues when the grid can’t handle all the energy.

Exaggerated estimates make curtailment more expensive — and more likely, traders and experts say. Overstatement increases the chance that grid managers will determine that there’s a risk of an overload, improving the odds that wind farms will be paid to shut down, they said.

There’s an additional cost to curtailment, for both the climate and for consumers. Even as it pays wind farms to curtail their output, the grid operator still needs electricity to meet demand in the south. So, National Grid staff members must pay local gas-fired plants to turn on.

In 2022 alone, those combined payments cost UK bill payers about £800 million and added more than a million tons of carbon emissions into the atmosphere, according to analysis by Carbon Tracker, a not-for-profit think tank that researches investment risks associated with climate change. Its report predicts that without faster infrastructure investments, that number will rise to more than £3.5 billion by 2030.

On April 11 last year, meteorologists forecasted gale-force winds in Scotland’s border country. Staff working on behalf of EDF’s Fallago Rig told the grid operator the site would start the afternoon producing 124 megawatts and top out in the evening at about 140 MW, close to its full capacity.

Once in the morning and once in the evening, Fallago Rig was curtailed — paid to switch off based on how much the wind farm said it would produce.

But when Fallago Rig was providing electricity, its output was 22% lower on average than forecast.

In all, Fallago Rig overstated its output for 13 of the 16 hours it operated.

If they were overstating at a similar rate during the times Fallago Rig was curtailed, its owners would have received an estimated £25,000 in extra compensation.

Scottish Power Ltd.’s Dun Law Wind Farm, which is about seven miles from Fallago, delivered a far more accurate forecast on April 11.

For Fallago Rig, the day wasn’t a one-off. The degree of its monthly overstatement during the period examined by Bloomberg fluctuated — sometimes it was as much as 50% — but it never dropped below 10%. At its monthly error rate, roughly £9.7 million of the £33.5 million the wind farm has received for curtailment over the past five years would be overpayments.

EDF said that its proprietary data would lead to other conclusions, but declined to provide further information and did not respond to specific questions about April 11. EDF operates Fallago Rig and holds a 20% equity stake. The remainder is owned by a fund managed by Federated Hermes Ltd, which declined to comment.

Other wind farms owned by EDF have also consistently overstated their generation forecasts. One is Dorenell, further north on the famous Glenfiddich Estate. Its projections missed by 26% over the study period. Dorenell’s overestimation has declined more recently: From September 2021 through June 2023 it was 14%.

Natural Power, which provides forecasting services for Fallago and Dorenell, said it receives no additional financial benefit based on the amount of compensation its clients collect. The firm said it had never received a query from the regulator relating to the forecast data it has submitted on behalf of its clients.

“The accuracy of these forecasts can be influenced by the site operational data available, which varies according to site and the specifics of the client’s contract instructions,” Natural Power said in a statement.

Ventient’s Farr wind farm also systematically overstated its output, some months by more than 50%. In every month analyzed after the first half of 2018, Farr overstated by at least 10%.

“It’s very concerning that some of these big energy companies are being rewarded for consistently overstating,” said Angus MacNeil, a UK lawmaker and the chair of the influential House of Commons energy security and net zero committee. Ofgem should claw that money back, MacNeil said. “It looks like some operators are gaming the system.”

In 2021, one of the UK’s largest wind farms came online: Moray East, run by a consortium called Ocean Winds, led by France’s Engie SA and Portugal’s EDP Renovaveis SA. Located 13 miles off the northeastern coast of Scotland, Moray can produce as much as 950 megawatts.

It has also exacerbated the grid’s congestion in the region, where SSE Plc’s Beatrice wind farm already provided nearly 600 megawatts of capacity. The UK’s electricity cables can’t keep up with all the new generation.

Moray has been curtailed more than any other wind farm since then, pulling in over £100 million, while Beatrice has received more than £58 million. During that span, Moray has been paid to switch off more than a quarter of the time it had intended to run, and Beatrice 17% of the time — dramatically cutting into the renewable energy they could have offered, Bloomberg found.

For the first 16 months it was running, the staff who operate Moray’s 100 turbines understated or accurately forecasted their output, according to Bloomberg’s analysis. But starting in September 2022 something changed. That month they overestimated its output by 6.5%. Since then they have tended to overstate — by 10% in May 2023, for example, and 15% in June, the last month for which Bloomberg has data.

“The UK has a mature electricity market, operated using well-developed regulations and a strong regulator with which Moray East are fully compliant,” Ocean Winds said in a statement.

Just a few miles away, Beatrice’s operators have for the most part filed accurate forecasts, but not always. Between September 2021 and July 2022 they tended to overstate their output by between 6% and 10%. That coincided with periods when their plant was heavily curtailed.

“SSE consistently provides the most accurate estimates we have to the system operator regarding the performance of our wind farms,” the company said in a statement. “The real story is that predicting the weather is not an exact science, as everyone knows.”

The UK has a grand vision to more than triple its wind turbines by the end of the decade. But interest rates have skyrocketed and the costs of raw materials such as steel have soared, raising doubts about whether that will come to pass.

Even if it does, unless there is a serious upgrade to the country’s transmission system, then the new generation will strain the network even further, driving up the cost of curtailment — and the incentive to game the system — even more, experts said.

“We are trying to patch and mend the fact that the location of the renewables generation is not aligned with the grid,” said Dieter Helm, professor of economic policy at the University of Oxford, and a UK government adviser on energy policy. “If nothing is done, then this system is going to get even more costly.”

(Updated to include new statement from Ofgem saying it has begun an investigation.)

Additional design and development: Demetrios Pogkas

With assistance by: Will Mathis

Edited by: Alex Campbell, John Voskuhl and Michael Ovaska

Methodology

Bloomberg analyzed millions of records from Elexon’s Balancing Mechanism Reporting Service and its Data Portal to identify wind farms that consistently overstated their output forecasts and were paid to turn off when those forecasts risked overwhelming the grid. The analysis, which was vetted by three experts on wind power, covers 2018 through June 2023.

Every day, companies that operate wind farms in the Balancing Mechanism report Final Physical Notifications to the grid, a forecast of how much electricity their generators intend to produce for each settlement period during the day. (Each wind farm can have multiple generator units.) Settlement periods are half-hour intervals that begin at midnight. Because final physical notifications can be reported for intervals shorter than a half hour, Bloomberg calculated weighted averages to summarize the FPN data for every half hour.

Bloomberg used Elexon’s Initial Settlement Run data for each wind farm’s actual metered output, and the Detailed System Prices data for the amount each wind farm was paid to turn off, called “curtailment.”

To calculate overstatement or understatement for each wind farm, Bloomberg took the difference between FPN and metered output, and divided that difference by FPN to get a percentage. For this calculation, Bloomberg filtered the data to remove outliers and make its analysis conservative:

•Bloomberg did not include any settlement period when curtailment was active.

•Bloomberg did not include any instance when the reported FPN was zero or when the metered output was zero.

•Bloomberg did not include any 30-minute settlement period between two back-to-back curtailment events because some wind farms could not ramp up production quickly enough, thus displaying extreme levels of overstatement during such periods.

•The following time periods were also excluded because the FPN data were extremely inaccurate when these wind farms first came online:

-BEATRICE: before July 1, 2019

-STRONELAIRG: before Jan 1, 2019

-GALLOPER: before June 1, 2018

-TRITON KNOLL: before July 1, 2022

To estimate how much a wind farm was overpaid in a month, Bloomberg calculated its overall percentage of overstatement during that month and applied it to the curtailment payment it received that month. The assumption was that a wind farm would overstate their FPN just as much, if not more, during curtailment periods compared to non-curtailment. For robustness, we conducted this analysis daily, monthly and over a 5-year period, to arrive at consistent results.

Additional Bloomberg NEF data were used to determine the ownership and location of each wind farm. [Link added.]

Related posts:

It's shocking reading. What clowns allow all these alleged green wind farms to be commisioned without the rest of the infrastructure in place? Like building supersonic trains but no tracks for them to run on. Paying extra for gas fired power stations on stand by is another shock.