"How Renewables Increase Your Electricity Bills" by David Turver

"How Sustainability by Numbers got Electricity Pricing Wrong"

The following is a reposting of another excellent analysis by David Turver.

How Renewables Increase Your Electricity Bills

How Sustainability by Numbers got Electricity Pricing Wrong

By David Turver • 27 August 2023

The articles are usually very well researched, and the writing style is clear and accessible. However, a couple of weeks ago Hannah Ritchiepublished an article entitled “If the UK has lots of renewables, why do electricity prices follow gas prices?” and I thought it was at best misleading. This article explains why, how electricity pricing really works and how renewables are increasing your electricity bill.

Misleading Costs of Renewables

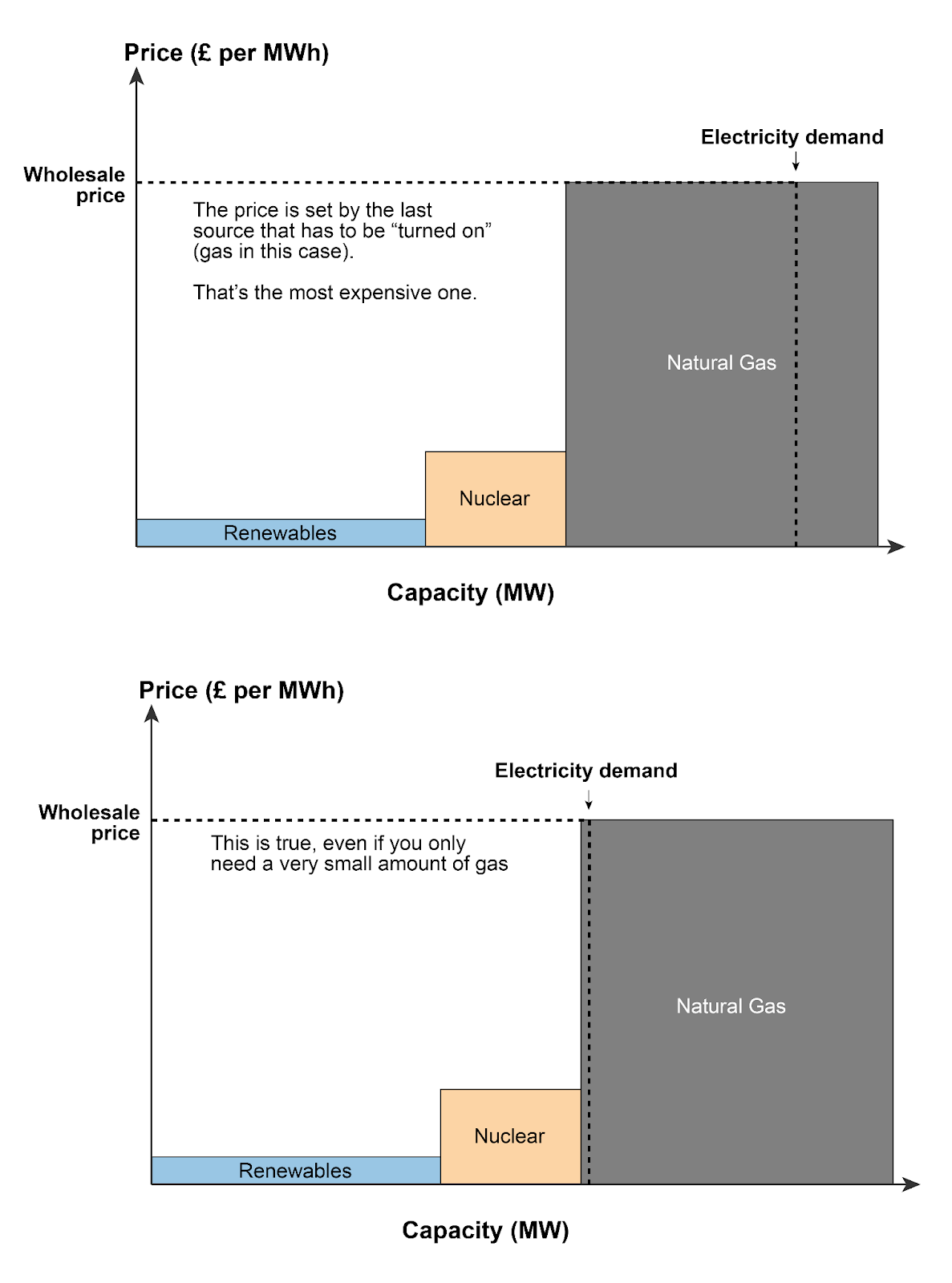

The basic explanation of the merit order method of deciding which generators get to supply the grid in Hannah’s article was fine. It was also true to suggest that when gas prices soared, our electricity bills also went up dramatically. However, what irked me was this chart (see Figure 1).

Figure 1 - Relative Prices of Electricity from Hannah Ritchie's Sustainability by Numbers

The chart shows how if demand is slightly higher than what can be delivered by a combination of renewables and nuclear, then the wholesale price of electricity is driven by the marginal price of gas. If the price of gas-fired electricity is higher than the other sources, then gas will set the price of the market. So far, so good, however I have a few problems with this chart. First, the y-axis scale seems to try and reinforce the myth that renewables are nine times cheaper than gas. Second, it also seems to suggest that the price we pay for renewables is the marginal cost of production. Both notions are false as we shall see below.

How Renewables Really Affect Your Bills

First, let’s reorder the x-axis because nuclear power is nearly always running, providing reliable baseload and adjust the pricing to show the approximate price of gas and renewables today, see Figure 2.

Typical Costs of Renewables

According to the LCCC, offshore wind farms operate at a wide range of strike prices for their Contracts for Difference (CfD). Triton Knoll operates at £106/MWh this year and the rest in the range £169-209/MWh. The onshore wind average is around £110/MWh. According to Ofgem, the average payments under the Feed-in-Tariff (FiT) scheme, mostly solar, were £196/MWh in FY21-22; it will be higher this year. So, for illustrative purposes, I have set the average strike price for renewables at £160/MWh in the chart. For gas, I have assumed £72/MWh as a typical price in July this year. It should be noted that this does fluctuate with gas prices. I have left the price of nuclear unchanged from Hannah’s work because it does not really feature in this article. Current nuclear plants are relatively cheap to run. The new Hinkley C plant will be much more expensive than shown on the chart.

On a day with high demand and strong production from renewables, the merit order might look a little like the above. The wholesale price of gas is setting the wholesale price of electricity. However, what we pay on our bills is not simply wholesale price plus costs of transmission and distribution. For renewables, we pay the strike price of the CfD or FiT payment. The wind generator might offer electricity to the market at a low price and receive the wholesale price for its power, but we pay the extra as a subsidy though our bills. In effect, we must pay the higher price for all the available renewable energy even if gas is cheaper.

What about new windfarms?

Much has been made of cheaper electricity coming from more recent offshore wind farms coming on-line, for example Moray East. This currently has a strike price of £74.49/MWh which is similar to recent prices for electricity generated from gas. However, Moray East has not taken up their CfD contract and are in effect receiving market prices for their power. So, they are no cheaper than gas.

Last year, some offshore wind farms won CfD contracts for £37.35/MWh in 2012 prices. However, one of the sites, Norfolk Boreas Phase 1 is not getting built because the operator Vattenfall says they can no longer deliver for that price. So, this farm and others like it are no cheaper than gas either because they are not getting built.

Impact of Curtailment

It gets even worse if demand is relatively low on a very windy day. Then supply exceeds demand and wholesale prices drop precipitously, sometimes to below zero, and we end up with a situation shown in Figure 3.

The wholesale price has fallen to very low values and some of the renewables are turned off because there is not enough demand to meet the available supply. This is called curtailment. However, even though the market value of the energy generated is low, we pay the much higher CfD strike price not just for the power supplied but also for the curtailed power. Yes, we pay for power we do not need and do not consume. We also pay to keep some of the natural gas plants idling in case the wind drops suddenly or when the sun sets. Also note that the wholesale price has fallen below the cost of nuclear, destroying the economics of that plant too, without bringing down our bills.

Impact of Dunkelflaute

Dunkelflaute is a German word for periods where it is dull with little wind. This type of weather is quite common in Northern Europe and means there are significant periods where little or no energy can be generated from wind or solar. In these cases, gas-fired generation has to step in to fill the gap as shown in Figure 4.

Of course, keeping gas-fired plants idle, waiting to step in when renewables cannot produce is expensive. They must spread the capital costs of the plant over fewer generated units because they cannot run at optimum load factors. This pushes up the cost of gas-fired generation. Ironically, these are often Open-Cycle (OCGT) plants that are only about half as efficient as Closed-Cycle (CCGT) plants, but OCGT generators can respond much quicker to rapidly changing supply or demand.

Impact of Higher Gas Prices

Proponents of renewables argue that because we saw an increase in gas prices in the latter half of 2021 due to supply constraints and a further spike when Russia invaded Ukraine in 2022, we should spend even more money on renewables. I have thought this through and come to an entirely different conclusion. If we see another spike in gas prices this winter as is entirely possible, then of course electricity prices will rise again as shown in Figure 5.

While gas prices are high, we will pay higher prices through our bills even though we receive a small rebate from renewables generators who must refund any extra they get above the CfD strike price.

Generally, a spike in gas prices will feed through to higher inflation. This higher inflation then passes through to index-linked CfD strike prices (and FiT payments) in the following year. So, even if gas prices have fallen by then, we will be paying even more through our bills for more expensive renewables as seen in Figure 6.

In fact, because CfD strike prices and FiT payments are index-linked, the price we pay for renewables will continue to rise with inflation for the life of the contract. This is perfectly illustrated by new data released by the LCCC as shown in Figure 7.

This shows payments to wind farms under the CfD scheme by month since 2018. They rose as new wind farms were brought on stream up to the beginning of 2021. As gas prices rose the CfD payments declined until the wind generators were paying back money for a short period during 2021 and 2022 when gas prices spiked. Now gas prices have fallen, but they are still above the pre-crisis norm, yet CfD payments to wind farms for July 2023 at over £150m are back close to the peaks in 2019 and 2020 when gas prices were low.

Conclusions

My conclusion from all this is that we should not be building more renewables. Instead, we should be investing in new sources of gas supply to bring down the cost of gas-fired electricity. Gas still supplies a very significant proportion of our electricity and if we want to mitigate the impact of the ever-rising cost of renewables, we must have cheap gas. This means we must re-start fracking. In addition, if we are serious about cheap energy, then we should scrap the carbon tax that artificially increases the cost of gas-fired electricity too. Lower gas-prices will also bring down the cost of home heating and make energy-intensive industry more competitive.

If you enjoyed this article, please share it with your family, friends and colleagues and sign up to receive more content.

Please share David’s original post and consider subscribing to his Eigen Values Substack:

Please also see these posts regarding “constraint” payments paid for by us as tariffs tacked on to our electricity bills when intermittent unreliable industrial wind turbines are “constrained” i.e. paid to switch off to help stabilise and balance the National Grid.

Please also see these related posts:

What's one of the MAIN functions of modern moron slaves in our current lovely Civilization?