I am reposting the following detailed article published by Stop These Things (STT) this morning as it provides a good overview of how the National Grid operates along with the detrimental impact upon its operation and costs to consumers which intermittent wind and solar installations create.

Why Intermittent Wind & Solar Always Deliver Higher Power Prices

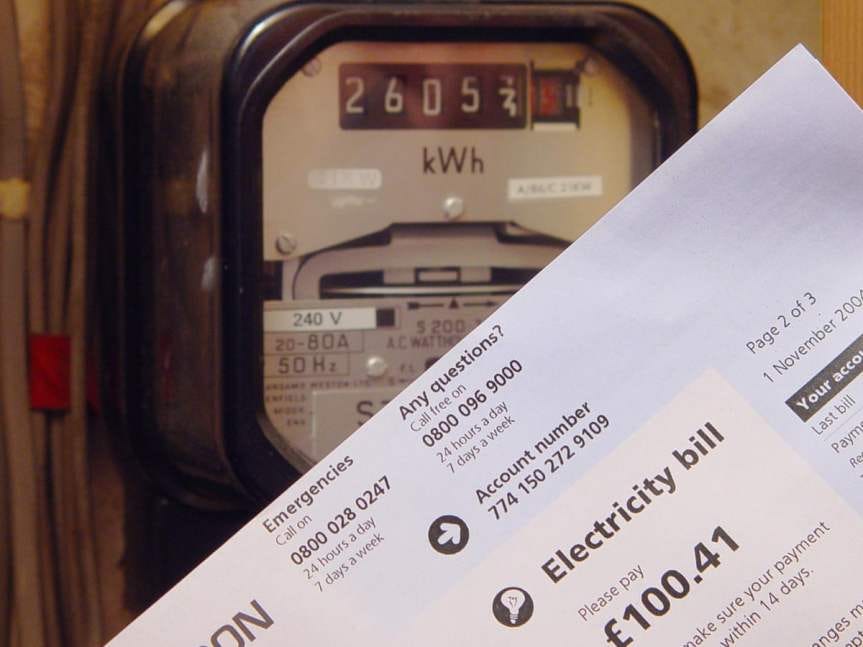

Looking to thank someone for your latest power bill, then look no further than subsidised wind and solar. The ‘unreliables’ are the principal reason why retail power bills are rising at unprecedented rates.

Behind the curtain, there are a number of forces at work which, over the last decade or so, have entirely upended the ordinary (and mostly orderly) market for electricity.

That market was complex enough. However, adding sunshine and weather-dependent solar and weather-dependent wind has turned complexity to chaos.

Andrew Montford provides a helpful primer below, explaining why your power bill is the highest, it’s ever been.

The Six Ways Renewables Increase Electricity Bills

Net Zero Watch

Andrew Montford

September 2023Introduction

There are many misconceptions about how electricity bills are affected by new generation capacity, and in particular by new windfarm capacity. Here I break down the main effects. To illustrate them, I will first look at a simple example of a ‘dash for gas’ in a fossil-fuel powered grid. Then I move on to look at the more complex case of a ‘dash for wind’ in a grid powered by gas and renewables. In both cases, the grid I describe is much simpler than the real one, so I close by considering whether what I describe is correct in practice.Costs and markets

The electricity market tends to favour generators with lower fuel costs: the ones with the lowest fuel costs always run, ones with intermediate costs run some of the time, and ones with high costs only get to run occasionally (this is called the ‘merit order’). However, it is important to understand that, no matter what its fuel cost, a generator still needs to cover all its costs (i.e. including capital and maintenance).Some can earn enough in the marketplace to do this, but others can’t. How it works is all bound up in the way the market works, and the fact that electricity is a commodity; in other words, everybody in the marketplace is selling the same thing.

A concrete example should make it all clear. Let us look at a grid running wholly on gas- and coal-fired power stations, and assume that gas has lower fuel costs and thus runs preferentially. When demand is sufficient to require both gas and some coal-fired units to run, the gas-fired units do not sell at a lower price, despite their lower fuel cost. Instead, they sell at the higher price demanded by coal-fired units – they are all selling megawatt hours, after all.

As a result, the wholesale market price for electricity tends to settle at around the fuel cost of the coal-fired units (we say the market price is ‘set’ by coal).

The market price varies though. At times of high demand, older coal-fired units will have to be fired up. Because these are inefficient, and also because they get to run comparatively rarely, they have high fuel costs and high total costs. But when they are called upon, they are indispensable, and they can demand very high payments. Since everyone in the market can see this coming, they all bid at the same prices they expect the old coal-fired station to get, and the market clears at a commensurately higher price. Consumers carry the cost.

Being able to charge those higher prices enables the gas-fired units to earn enough money to pay for their capital and maintenance costs as well as their fuel. However, this is not an option for the coal-fired units (or perhaps just the least efficient ones), which will therefore require a subsidy to keep them in the market.

A dash for gas

Now consider what happens when you add to the generation mix a new, lower-cost source of generation, such as a state-of-the-art gas-fired power station. How will market prices change?It’s important to note that there is no direct effect, because market prices are set by coal. However, there are many indirect effects.

Firstly, the coal-fired power stations all get to run less often. This will increase their fuel costs somewhat, since they will use coal less efficiently if they are switching on and off more often. So, counterintuitively, one effect of adding new, lower cost generation (in this case a new gas-fired unit) to the generation mix may be to increase market prices, and thus the amount that consumers have to pay to every generator on the grid. In addition, since some of their costs are fixed (in other words they are unaltered by output changes – the obvious example being depreciation), their total costs per megawatt hour, and thus the price they need to achieve in the marketplace, increase even further. One way or another, consumers have to pay this too. We’ll call this the inefficiency effect.

It is possible that the least efficient coal-fired power station will decide that a reduction in operating hours is intolerable, and it will decide to shut up shop. If that happens, market prices going forward may well be set by a somewhat more efficient coal-fired power plant, thus tending to push market prices down again. We’ll call this the displacement effect.

However, grid managers may decide that these units are indispensible for dealing with periods of very high demand. They will therefore offer them a financial bung to make them stay around. We’ll come back to this subsidy, which we’ll refer to as the capacity market effect (after the mechanism currently used to deliver it).

If more and more gas-fired power stations are added, these effects will continue in tandem. However, eventually, there will be some periods of low demand when no coal-fired units are required at all. When that happens, the wholesale market price will no longer be set by coal, but by gas. This will cause a sharp drop in prices, which will then feed through to consumers. As more and more gas-fired units come on stream, average market prices steadily decline.

Thus dashing from coal to gas will eventually make consumers better off.

A dash for wind

When the new generation capacity is wind rather than gas, things are rather different. Imagine a grid that is a mixture of gas-fired power stations and windfarms – much like the one in the UK today – to which a new, state-of-the-art windfarm is added.As in the previous example, the fuel costs of the new generator are lower (for wind they are zero!); in other words, wind will run in preference to gas. However, because of their very high capital costs and low output, wind’s total costs are – except in exceptional circumstances – so high that there is no possibility of them being earned back through selling electricity. As a result, subsidies will be necessary to get the windfarm built. These subsidies – the Renewables Obligation and Contracts for Difference (CfDs) – are levied on electricity suppliers and thus directly exert upward pressure on consumer bills (that is, outside the wholesale market). We’ll call this the levy effect.

Once it is operational, the windfarm produces effects that are similar to those seen in the dash for gas. For example, the inefficiency effect is still in play: each new windfarm will reduce the efficiency of the gas-fired power stations, thus pushing market prices upwards.

Similarly, the displacement effect will still be in operation too, with older, less efficient power stations eventually nudged out of the marketplace, and the market price thus tending to be pushed down again. However, this time there is a crucial difference. Because the wind turbines are intermittent, they are not a direct replacement for gas-fired power stations. If, say, we replace a 1-GW gas-fired unit with three 1-GW windfarms, delivering on average 33% of their nameplate capacity, the annual output is theoretically the same. But 33% is the average; at times, the windfarms will deliver nothing at all. As a result, we still need that 1-GW gas-fired unit; if it has left the marketplace, we may sometimes be left with a catastrophic shortfall in supply. Thus, when renewables are involved, it becomes much more important not to let old, inefficient generators leave the marketplace; the capacity market effect will be seen to a much greater degree, and there will be little or no relief from the displacement effect. Consumers carry the cost of ensuring this back-up generation remains in place.

If we go on adding windfarms to the grid, there will eventually be periods of low demand and/or high wind generation in which the gas-fired power stations are no longer required to run. At these times, the market price will be set by the fuel cost of a wind farm. Since this is zero, the market price will drop to approximately zero too. (Such very low prices are already seen occasionally on the UK grid). In fact, windfarms in the Renewables Obligation can bid negative prices into the market because they will still receive generous subsidies on top of whatever they are paid for power. However, windfarms in the CfD regime have different concerns. CfDs essentially give generators an agreed fixed price, typically above market prices. However, the rules state that this top-up is only paid when the market price is not negative. Thus CfD windfarms will bid into the market just above zero, and this is likely to be the price at which the market clears. They then receive a large top-up to take them back to where they expected to be. In other words, there is no gain to consumers – the low price inside the wholesale market is completely cancelled out by the high subsidy levied outside it. On the other hand, the Renewables Obligation units will take a (possibly large) reduction in income. This means a gain to consumers, at least in the short term. However, assuming the level of the Renewables Obligation is no higher than required to make these windfarms competitive, they will have to counterbalance periods of below-average prices with periods of above-average prices in order to make the necessary returns. Thus there may be no gain to consumers at all.

There are other effects arising from windfarms’ intermittency too. The Balancing Mechanism is the grid’s process for ensuring that the electricity system remains stable. The costs of fixing any imbalances between supply and demand are passed on to electricity system users. The best known of these costs are constraints payments, which are incurred when windfarms in far-flung locations cannot get their power to market due to limitations in grid capacity. In these circumstances, they are paid to switch off, and another generator (typically a gas-fired power station) located closer to the consumer is paid to switch on to ensure the windfarm’s customer gets their required power.

The grid has also had to introduce a new service in response to the growth of wind power. Gas-fired power stations naturally stabilise the grid (providing so-called ‘inertia’); a fault in one place tends to propagate slowly across the network, giving managers time to respond. However, windfarms have no inertia, and faults can therefore propagate almost instantaneously, threatening major blackouts. In order to mitigate this risk, the grid pays for artificial inertia, typically in the form of flywheels and batteries. In other words, a service once provided for free by gas-fired power stations is now

a further burden on consumer bills.Finally, because windfarms tend to be built far from centres of demand (in the ocean, and in remote highland areas), they bring with them the necessity for major upgrades to the transmission grid. The costs of what we can call the transmission effect are charged to users of the grid, ultimately raising consumer bills still further.

Summary

In summary, adding a windfarm to the grid increases costs to consumers in no fewer than six ways:

The inefficiency effect

The capacity market effect

The levy effect

Constraints payments

Artificial inertia

The transmission effect

Only the displacement effect could theoretically reduce costs to consumers, but in practice this is likely to be zero, because of the urgent need to keep gas-fired power stations on the grid.

In summary, it seems implausible that windfarms will ever reduce costs.

Table 1 gives indicative costs for each effect, suggesting a total of £24.5 billion, or around £850 per household per year. Approximately half of this will be experienced as increases in household bills, and the rest as increases in the general cost of living.

Caveat

When I began, I observed that my examples described grids that were simpler than the real one. In particular, I looked at grids with centralised dispatch based on the different bids from generators. The reality of the UK market is rather different, with only a fraction of total electricity traded on the open market; most is delivered under the terms of private ‘power purchase agreements’, and generators tend to ‘self-dispatch’. However, this may make little difference to my conclusions. Most of the effects outlined above are a function of physical and engineering constraints rather than of market structures. Differences are therefore likely to be of degree.

Net Zero Watch

I didn't give you permission to use my photograph, however, since this article explains why we need more hot water bottles and should stock up now, I give permission retrosectively. ;-)