"Starmer’s secret plan for energy prices is terrifying" by Gordon Hughes

"Labour is about to plunge Britain into a fresh energy price crisis in the name of Net Zero"

The following is a reposting of an article by Gordon Hughes as published by The Telegraph today, regarding what would be the dire reality of life in the UK should Starmer be elected the next Prime Minister in the upcoming election.

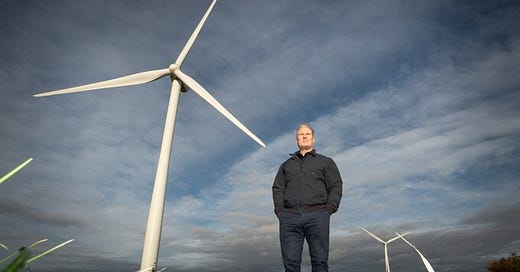

Starmer’s secret plan for energy prices is terrifying

Labour is about to plunge Britain into a fresh energy price crisis in the name of Net Zero

By Gordon Hughes • 22 February 2024 • 9:00am

When Sir Keir Starmer pulled back from Labour’s commitment to spend £28 billion per year on green projects, it was no surprise. The number never made sense given the other pressures on public spending. Unless Labour intended to increase either income tax & National Insurance or VAT by a large amount – in the region of raising VAT’s standard rate from 20 per cent to 24 per cent – it would have been extremely difficult to afford.

But there is a catch. There is no indication that Labour intends to step back from its Net Zero commitments. So where is the money going to come from? There is no magic money tree and the costs of achieving Net Zero targets appear to be rising rapidly. Even the £28 billion figure would have been little more than a down payment on the long-term costs. It is about 1 per cent of GDP which must have sounded like a convenient round number. However, Michael Kelly, a distinguished engineer who examined the costs of reaching NetZero, concluded that the total cost is likely to exceed 4 per cent of GDP up to 2050.

If not through taxes like VAT, then how does Labour intend to pay for this? Room for borrowing is tightly constrained by the party’s fiscal rules, which leaves only one likely option: stealth taxes on you and I, on all households and businesses in the UK. These may take many forms – levies on electricity and gas prices, mandatory requirements to buy EVs and heat pumps, constraints on what we can eat or consume, and so on. Our daily life will be more expensive and inconvenient than it might have been, with limited or no incentives to use resources more efficiently or to improve our standard of living. For anyone of a certain age this is back to the dreary 1970s with vengeance.

Sadly, the impact of stealth taxes on daily life is only the beginning of the story. Most of the £28 billion was required to underpin the goal of decarbonising the electricity system by 2030. That is quite probably physically impossible but consider how this might play out. In 2022 the UK consumed an average of 4,060 kWh of electricity per person excluding use in the energy sector. Only 1,425 kWh of that total was used by households with the remainder being consumed by industry, commerce and services. £28 billion per year is equivalent to 10.2p per kWh for all electricity consumption, or 29.1p per kWh for domestic electricity consumption.

The cost of £28 billion per year on households would exactly double the current price cap of 29p per kWh for domestic customers. Since most people regard the current cost of electricity to be extremely high, imagine how household budgets would look if the price of electricity were doubled. Not much incentive to buy electric vehicles since they would be significantly more expensive to run – and with no prospect of a reduction in charging costs.

The situation would be arguably even worse if a levy were raised on all electricity consumption. The UK’s electricity prices for industry are among the highest in Europe at 12.1p per kWh for very large industrial consumers in 2023Q3 and 20.7p per kWh for large industrial consumers. Adding 84 per cent for very large consumers, or 49 per cent for large consumers to electricity costs would hardly improve the UK’s attractiveness to industrial investors. What would the economics of Tata Steel’s new electric arc furnaces in South Wales look like if electricity costs were nearly double their current level?

In any case, putting levies on the electricity prices paid by non-household customers is simply an indirect – and inefficient – way of taxing households because the costs would have to be passed on. The inefficiency arises because businesses may close down or the numbers of teachers and nurses may be reduced in order to meet the higher operating costs.

There is no escaping Labour’s dilemma. The party’s Net Zero goals are inordinately expensive. Abandoning the £28 billion public spending target while maintaining the goals just makes everything worse for households and businesses. Sir Keir should now change the goals – and then decide how to pay for them.

Professor Gordon Hughes is a retired Professor of Economics at the University of Edinburgh, and a former senior adviser on energy and environmental policy at the World Bank

Related posts:

Thank you for your good work, Azra. The sheer stupidity of this nonsense which masquerades as "environmental" and actually is a giant wealth transfer is almost beyond belief. Fortunately, a lot of ordinary people are very suspicious of it though the middle and upper-middle classes seem to eat it up. There is talk of putting a giant wind project on an island here in Maine, U.S.A., and people are protesting its location because the island is an important bird sanctuary. But the people protesting are so dumb they want it put on the next spit of land and somehow think that will protect birds.