Whilst Siemens Energy stock prices plummet amid turbine failures, Professor Gordon Hughes says, "Wind costs will remain high"

I recommend reading the following information written by Professor Gordon Hughes which was included in a press release by Net Zero Watch in response to, Siemens Energy stock price plummets amid turbine failures reported Friday, 23rd June.

Professor Hughes is a former Professor of Economics at the University of Edinburgh, and was a senior adviser on energy and environmental policy at the World Bank until 2001.

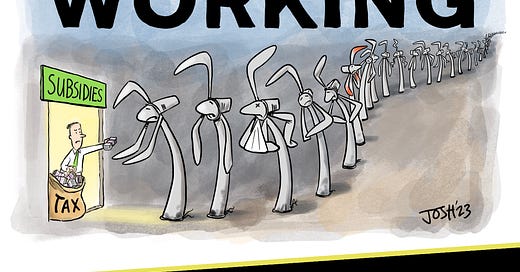

Wind costs will remain high

By Gordon Hughes • Monday 26th June 2023

The crash in Siemens Energy’s share price on Friday has admirably highlighted an issue with wind costs that colleagues and I have been examining for more than a decade. The painful facts are that:

(i) wind generation, both onshore and offshore, is more expensive than we are being told and

(ii) the performance of wind turbines tends to deteriorate with age, in significant part because of the kind of failures reported by Siemens Energy.

There is strong evidence to support these conclusions, which has been presented in reports published by the Renewable Energy Foundation in 2012 and in 2020 for the UK and Denmark, with updates provided by the Global Warming Policy Foundation and Net Zero Watch.

The news about Siemens Energy brings a strong inclination to say ‘you were warned’. However, their travails are a symptom of a much more widespread disease, which affects all of us, either directly through the costs of electricity or indirectly as the owners of wind farms (via pension funds and other investment vehicles). The plunge in the share price of Siemens Energy is dramatic, but that may be written off as a temporary market response to disappointed expectations. We need to look beneath the immediate story to understand the reasons for the disappointment and their implications for the prospects for wind generation.

The announcement by Siemens Energy focused on higher-than-expected failure rates for their onshore turbines. These were ascribed to problems with key components, but newspaper reports suggest more systematic design faults in recent generations of large turbines. Previous announcements have referred to problems with offshore turbines, and the market reaction suggests few believe that the current problems are confined to onshore turbines. Further, while each of the major turbine manufacturers has its own specific problems, Siemens Energy is not unique in experiencing high warranty costs due to higher than anticipated failure rates.

In increasing order of importance, there are three aspects to note:

(a) Siemens Energy and other manufacturers have given warranties on performance that won’t be met because of higher failure rates. They will incur additional expenses, either to replace components or to compensate wind farm operators for any resulting underperformance. Those costs are the basis for the write-offs that Siemens Energy has had to take. Investors will be painfully aware that the company has been declaring profits when they sell wind turbines, but without making adequate provision for future warranty repair costs.

In accounting terms this is known as recognising future profits for new contracts. When it becomes clear that the contracts will be less profitable, the company must write down the value of previously reported profits and, thus, the value of the assets on its balance sheet. In effect, though perhaps entirely innocently, the company has been misleading investors about its past and current profitability. Senior managers should be feeling very uncomfortable about their positions since the problem was predictable (and predicted).

(b) Warranties have a limited period – often 5 to 8 years – but the higher failure rates will persist and affect performance over the remainder of the life of the wind farms where the turbines have been installed. Their future opex costs will be higher than expected, and their output will be significantly lower. This will reduce their operational lifetimes, which are determined by how the margin between revenues and costs changes as wind farms get older. Lower revenues and higher costs bring forward the date at which replacement or repowering is necessary. These changes will reduce, often quite substantially, the returns earned by the financial investors – pension funds and other – to whom operators sell the majority of the equity in wind farms after a few years of operation.

(c) Siemens Energy and other manufacturers may argue that they can – with time – fix the component and design problems which lead to high failure rates. They may well be correct. The history of power engineering is littered with examples of new generations of equipment which experienced major problems when first introduced but which were eventually sorted out. Many companies have found themselves in severe financial difficulties or even forced into bankruptcy by these “teething” problems. The error in this case has been to pretend that wind turbines were immune to such failures.

The whole justification for the falling costs of wind generation rested on the assumption that much bigger turbines would produce more output at lower capex cost per megawatt, without the large costs of generational change. Now we have confirmation that such optimism is entirely unjustified – the whole development process has been a case of too far, too fast. Again, this was both predictable and predicted. The idea that wind turbines are immune to the factors that affect other types of power engineering was always absurd. The consequence is that both capital and operating costs for wind farms will not fall as rapidly as claimed and may not fall significantly at all. It follows that current energy policies in the UK, Europe and the United States are based on foundations of sand – naïve optimism reinforced by enthusiastic lobbying divorced from engineering reality.

In the longer term it is (b) and (c) that are the big story. With respect to (a), serious analysts have long since recognised that claims made about future wind costs and performance by the wind industry should not be taken seriously. It has been obvious that they were kidding themselves and their investors ever since the last 2010s. Unfortunately, we have now been tied into a high energy-cost future, with all the implications that has for the economy and standards of living.

I had previously posted the following additional information on my Facebook profile on 23rd April with regard to other legal liabilities which have affected Siemens and Vestas.

𝐒𝐔𝐒𝐓𝐀𝐈𝐍𝐀𝐁𝐋𝐄 𝐑𝐄𝐓𝐔𝐑𝐍𝐒?

The following are excerpts from the article, From GE to Siemens, the wind energy industry hopes billions in losses are about to end published 17 April 2023 by CNBC.

𝐊𝐞𝐲 𝐏𝐨𝐢𝐧𝐭𝐬

• The wind energy sector has been in crisis mode as reduced tax incentives, rising interest rates and inflation plagued turbine manufacturers and land-based and offshore wind projects.

• Siemens lost nearly $1 billion on wind last year; pure-play Vestas saw an operating profit decline of 369%.

• The Inflation Reduction Act has renewable energy companies encouraged about the outlook and contemplating more wind manufacturing in the U.S., and the stakes are high: “To be crystal clear,” Siemens Energy CEO Christian Bruch told CNBC in November, “energy transition without wind energy does not work.”Read more here.

♦︎

During their September 2022 marketing event in New Radnor which they called a "public consultation” I asked one of the Bute Energy representatives what information they had to support the alleged 40 year life span they were purporting for the 36 x 220m tall industrial wind turbines with which Bute plan to desecrate and destroy the Radnor Forest, if they are granted planning permission.

In response I was told that the 40 year lifespan was what the manufacturers had told them. When I asked which manufacturer had said this, they replied that they were in discussions with both Siemens and GE with regard to using, purchasing their turbines for their proposed Nant Mithil Energy Park atop the ancient domed hills of the Radnor Forest. Given that the lifespan of industrial scale wind turbines is on average, no more than 20 years, the only way that this “energy park” could last 40 years is if the turbines were repowered or replaced.

It is interesting to note that Siemens and GE recently settled a patent dispute over wind turbine technology.

"Siemens Gamesa stated in a 3 April 2023 press release that, “GE and Siemens Gamesa have reached an amicable settlement of all their wind turbine technology patent disputes in the US and Europe on confidential terms and have granted each other and their respective subsidiaries worldwide cross licenses under the asserted patent families, for the life of those patent families.” Source at Energy Live News.

Please also see these related posts:

"Wind Power Has A Profitability Problem" by Felicity Bradstock

I thank Irina Slav for referencing this interesting article in her recent piece which I will be reposting separately. It gives one hope when our beautiful rural hills and vales of Wales are being targeted by dodgy “wind” developers whose sole motivation is profits for themselves, their partners such as, Copenhagen Infrastructure Partners in particular, …

Why capital & maintenance costs of offshore wind energy projects are increasing and the promise of “green” jobs has “never been realised anywhere

I cannot recommend highly enough listening to this interview with Gordon Hughes by Robert Bryce. The discussion about the transmission cables required for offshore wind developments is incredibly important. On the subject of costs, Gordon Hughes also states as follows:

"Exploding the Cheap Offshore Wind Fantasy" by David Turver

Photo via Submarine cables to carry energy onshore from East Anglia ONE offshore wind farm by Nexans