"Wind farms investigated after ‘overcharging customers by £100m’" by Jonathan Leake

"Companies face market manipulation review for alleged inflation of compensation payments"

EDF’s Fallago Rig wind farm, Lammermuir Hills in the Scottish Borders via Spreng Thomson

I was very pleased to see the following article written by Jonathan Leake published by The Telegraph this past Sunday which I am reposting in full per the archived version.

Wind farms investigated after ‘overcharging customers by £100m’

Companies face market manipulation review for alleged inflation of compensation payments

By Jonathan Leake • 24 March 2024 • 6:32pm • The Telegraph

Wind farm owners are being investigated by the energy watchdog for alleged market manipulation after they were accused of overcharging consumers by £100m.

Ofgem is to examine claims that renewable energy companies artificially inflated compensation payments given to them for switching off their turbines on windy days when the grid did not need extra capacity.

It has been handed a dossier gathered by analysts at the Renewable Energy Foundation (REF), which suggests wind farm companies could be boosting the price of “virtual energy” they never actually generated.

An Ofgem spokesman confirmed that the claims had been received and an investigation has begun into whether any rules were broken.

John Constable, director of REF, a charity that has frequently highlighted excessive payments to wind farms, said: “Our evidence suggests that multiple wind farm operators have been charging over the odds to reduce their output on windy days, generating no energy but costing consumers a fortune.

“We estimate it added £100m to overall consumer bills in 2023 alone.”

REF claims that operators overcharged for constraint payments, the cash given to electricity generators to switch off wind farms and other assets when the national grid risks being overloaded.

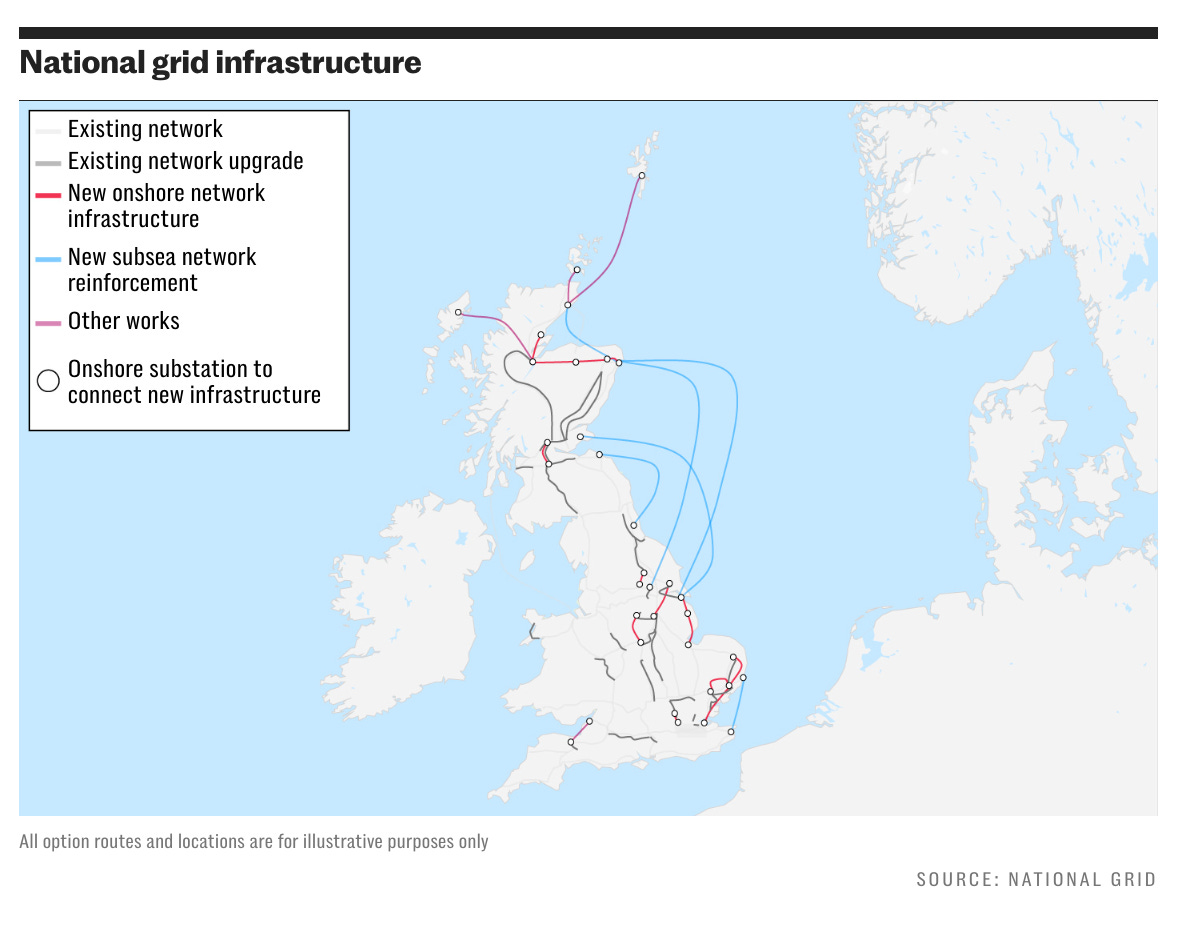

On windy days, the output from Scotland’s turbines surges to an unmanageable level because there are too few national grid links to carry their power to England’s cities.

When this happens, the National Grid Electricity System Operator (NGESO) tells wind farms to “constrain” their output – meaning they must switch off, and therefore earn less money from the subsidy system that underpins renewable generation.

The farms are then allowed to claim compensation for this lost income, with the costs added to consumer bills. However, the complexity of the system has given rise to multiple opportunities for overclaiming.

Ofgem is already investigating a separate allegation of wind farm overcharging that is estimated to have cost bill payers £51m since 2018.

Earlier this month, the regulator ordered Dorenell Wind Farm in northern Scotland, which is owned by EDF Renewables, to repay £5.5m.

Ofgem said the firm had “charged excessive prices to reduce output where this was required to keep the system balanced and the breach pushed up costs for consumers”.

Dorenell accepted the findings and co-operated with the investigation.

REF said its analysis showed such problems went far beyond a single wind farm or operator and that the key cause was the wind farm owners were allowed to set their own price for the foregone power.

Lee Moroney, an REF analyst, said: “This is virtual electricity which never actually existed except on paper.

“Ofgem is allowing these wind farm operators to set their own prices for notional electricity without checking that the prices reflect their actual costs and lost income.”

Ofgem has tackled some recent cases of overcharging. Last year it recovered £77m in fines, customer refunds, and compensation from power suppliers, up from £27.3m in 2022.

Many of these penalties were for overclaiming on constraint payments. In January 2023, electricity generator Drax Pumped Storage Limited had to pay £6m after overclaiming for the power it was told not to generate.

Last June, Ofgem told SSE Generation Limited (SSE) to pay £9.8m for seeking excessive payments from NGESO in relation to its Foyers pumped storage power station in Northern Scotland.

Another generator, EP SHB Ltd, was told to repay £23.6m last October after overclaiming on constraint payments for its South Humber Bank gas-fired power station.

An Ofgem spokesman said it disagreed with the Renewable Energy Foundation’s claim that wind farms could name their price for turning down generation, but confirmed an investigation was underway.

He said: “We already have a robust set of rules in place which explicitly exist to prevent generators from abusing the energy market in such circumstances. We have required several generators to make multi-million-pound payments in the last year alone where those rules have been breached.”

The spokesman added that REF’s allegations were now subject to investigation.

He said: “Ofgem works with [NGESO] to look into alleged improper behaviour of wind farms and other generators. We’ll consider all the facts and if evidence of a breach of market rules is found we will not hesitate to act.

“We are also currently consulting on whether any changes are required to the licensing rules in this area.

“We have passed figures provided by REF to our Generation Licence casework team, which will look into any report of potential market manipulation and assess each report on a case-by-case basis.”

Renewable UK, the trade body for the wind energy industry, said: “As the independent regulator Ofgem is best placed to comment on this.”

I had previously shared in early February information regarding Bloomberg’s three year investigation of these same issues the results of which led to allegations that “some UK wind farms may have added nearly £51 million to our bills since 2018 by overstating their power output.”

In my lay opinion it appears that some wind operators have been gaming the system to profit even more from the generous constraint payments which end up being paid for by we increasingly financially burdened consumers in the UK.

If you haven’t already, I highly recommend reading about the Bloomberg investigation.