'UK Renewable Energy Prices Set To Rise as Government Panics' by David Turver

This is another excellent article by David Turver which I recommend reading.

Renewable Energy Prices Set To Rise as Government Panics

Government consults on ways to add non-price factor bungs into CfD auction scheme

David Turver •18 April 2023

Introduction

Mid-way through the current auction for renewable energy, the Government has launched a consultation on introducing non-price factors into the Contracts for Difference scheme. The details of the consultation can be found here.

The current round of auctions is referred to as AR5. There is a micro-site covering the details of the auction. The auction was launched on 30 March 2023 and the application window is due to close on 24 April 2023. The consultation about introducing non-price factors was launched on the micro-site yesterday. It strikes me this is a panic measure, probably because early indications from the bidding round are not favourable. Back in February, lobby group Energy UK called on the Chancellor to provide extra support for renewables citing inflation, interest rates, supply chain difficulties and poorly designed windfall taxes as reasons why projects approved during AR4 might not go ahead.

Energy UK also warned that the costs for AR5 and AR6 would increase and that Government expectations for Administrative Strike Prices (ASPs) where too low.

What happened to the claim that offshore wind is nine times cheaper than gas?

Rationale for Introducing Non-Price Factors into CfD Auctions

The Government is committed to a fully decarbonised electricity system by 2035, subject to security of supply considerations, with an ambition to deploy up to 50GW of offshore wind by 2030, including up to 5GW of floating offshore wind, as well as 70GW of solar PV by 2035. However, the industry is facing a number of challenges including renewable energy supply chains struggling to cope with upward pressure on costs; increased supply chain disruption; surging global demand for renewable energy and limited manufacturing capacity for key components.

They want to use this consultation to explore the introduction of non-price factors into the CfD auction process. The factors they are exploring are sustainability, addressing skills gaps and enabling system flexibility. Note that none of the NPFs they are exploring appear to directly address the challenges they identify. However, the consultation does acknowledge that the current CfD scheme is driving an inefficient balance of variable generation.

Impact of Introducing Non-Price Factors

The Government admits that if these proposals go ahead, the cheapest bids would no longer automatically win in the auction, so consumer prices are bound to rise. The impact of introducing NPFs into the CfD auctions will be to increase prices. The Government have proposed three options for their introduction.

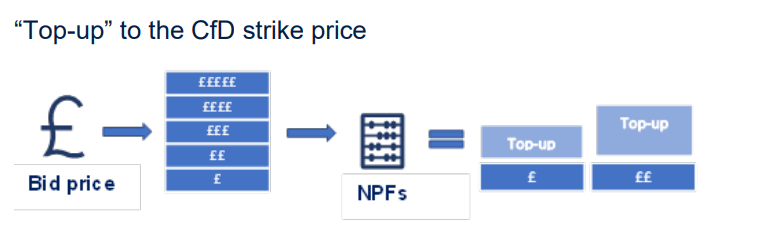

The first is a simple “top-up” to the CfD strike price. In other words, a simple bung in addition to the price bid by the developer.

The idea is that bidders would receive a top-up bung of a certain amount for a number of years of their CfD contract. Bidders would have to commit to certain additional investments to support the Government’s deployment targets. It does seem rather odd that a commitment to 50GW of wind and 70GW of solar is not sufficient incentive already.

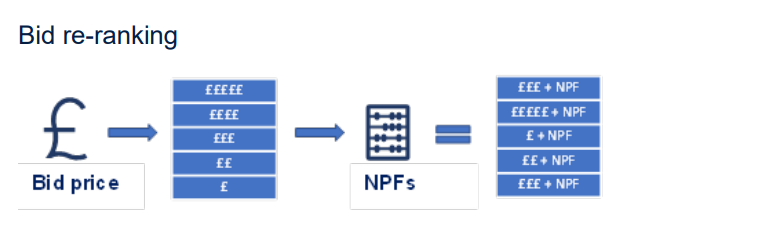

The second option is to re-rank the bids based on NPF scores, making it possible for more expensive bids to win out over the lowest priced bids.

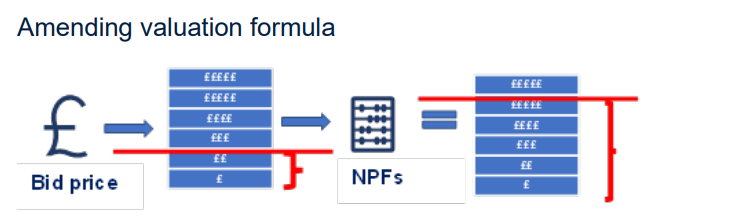

There are two variations to this option, but we don’t need to go into that detail here. The third option is even more complex involving amending the valuation formula.

In essence, this means that bids that scored highly on NFPs would be calculated to have a smaller impact on the overall CfD budget.

The Government is also proposing to relaxing the penalties for non-conformance with the CfD contract. The current regime includes the right to terminate for non-delivery of commitments. The Government is proposing this be relaxed for NFPs to withdrawal of the top-up or a range of financial penalties proportionate to the level of non-delivery.

Conclusions

It is clear that the Government’s plans to saddle us with more unreliable energy are coming off the rails. I have already covered the bursting of the offshore wind fantasy, noting that it would be surprising if wind prices did not rise in the face of rising commodity prices and increased cost of capital. However, instead of stepping back and reviewing their entire energy policy, the Government is looking at ways to further increase the eye watering costs of renewables. This is a salutary lesson in how Government intervention always begets more Government intervention. These extra subsidies will go towards propping up industries that are already struggling to survive because fundamentally, they are delivering products that simply are not useful. If the EU and the USA want to subsidise these useless industries, then let them. But that does not mean we should follow suit.

Renewable energy sources are low density, low EROEI sources that do not score well on most sustainability scores. In the end they produce only intermittent energy that adds cost and destabilises the grid. Adding extra subsidies and tinkering with their structure will not alter any of those fundamentals. The Government is running out of time to realise bad economics will never win over the Laws of Physics.

They should scrap this consultation, scrap any further subsidy for wind, solar and biomass and instead invest time and money into high density, high EROEI, reliable energy sources on which we can run a modern economy.

Please share David’s original post: