"Addressing the high real cost of renewable generation" by Kathryn Porter

I am reposting the following excellent analysis prepared by Kathryn Porter in 2022 to add to the body of research about “renewable” energy which I aim to build on this blog.

Addressing the high real cost of renewable generation

By Kathryn Porter • Watt-Logic • 11 April 2022

Over the past few months we have been inundated with claims from interested parties that more renewables are the (only) solution to the energy crisis. They also claim that renewable energy is cheap, deflationary, and will deliver lower bills to consumers. They tend to ignore questions about managing intermittency and the cost of back-up, pointing to “studies” that show a near-100% renewables energy system is “possible”. Some are actually quite rude when challenged on the subject (I have been invited to educate myself and told I may as well work in a shop, which seems offensive both to me and to retail workers…). In this post I will explore the actual cost of renewable generation for consumers. Anyone who finds actual data inconvenient or offensive should look away now…

Setting the scene

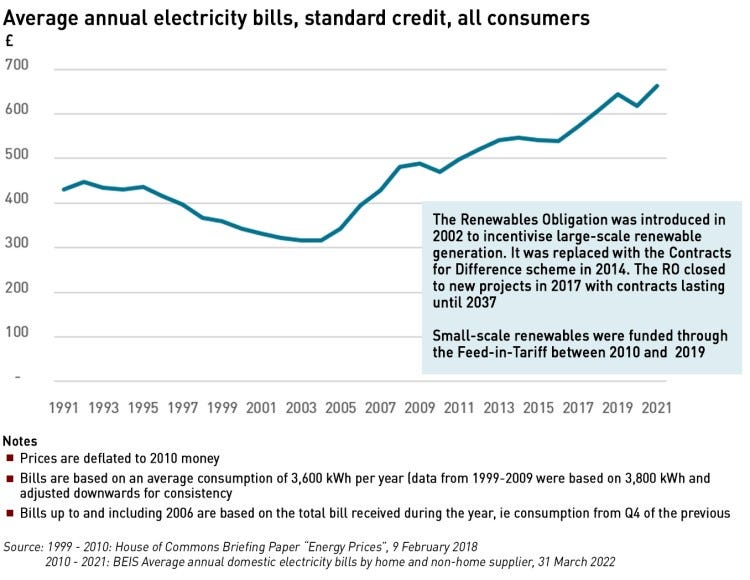

I think it is important to remember what we had before we began the energy transition. In Britain, we were just finishing the decade-long process of privatising and un-bundling the electricity market. At the turn of the century, we had an electricity system that was heavily fossil-fuel dominated, and arguably over-supplied as a result of the “dash for gas”. The decade since 1990 had seen electricity bills falling, so privatisation was largely seen as a success. Electricity was generated in large power stations connected to the high voltage grid, and demand was for the most part passive. Balancing supply and demand in real time was relatively simple – demand fluctuated based on the weather in largely predictable ways and output could be dispatched to match. Capacity margins were healthy, and blackouts were only thought of in the context of industrial action (memories of the 1970s being still fresh) or acts of God such as lightning hitting key infrastructure.

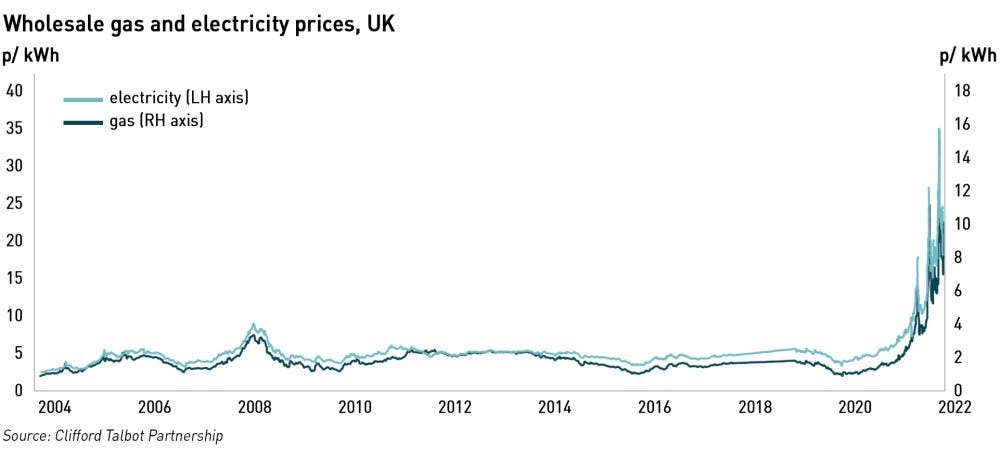

The beginning of this century saw two major changes: the first was the final separation of the “last mile” of the electricity market with the creation of suppliers and their separation from network companies under the Utilities Act 2000. Now consumers had proper choice over from whom to buy their energy. The second major change was the introduction of the Climate Change Levy in 2001 and the Renewables Obligations in 2002 (yes, it is now 20 years since we started subsidising off-shore windfarms). The years since these changes have seen end user electricity costs rise steadily, while wholesale prices have shown no such trend.

Costs of renewables are (not) falling

“Renewables” is a broad church, and in some respects the costs have been falling. Small-scale solar schemes are no longer eligible for subsidies in Britain, but they continue to be built, albeit at a slower rate. Most new solar projects are large-scale, and overall 1 GW of new capacity has been added since the subsidy schemes ended. However, costs have been rising in the past couple of years due to supply chain issues.

This illustrates the difficulty of the falling costs narrative: as technologies mature, the experience curve dictates that costs will fall, but they are not immune to global supply and demand dynamics. As technology costs fall, demand might increase, and if supply cannot keep up, then prices will rise, irrespective of any gains from the experience curve. This has certainly been seen in the case of solar panels, with constraints in the polysilicon supply chain (setting aside the ethical issues of buying materials tainted by claims of forced labour use).

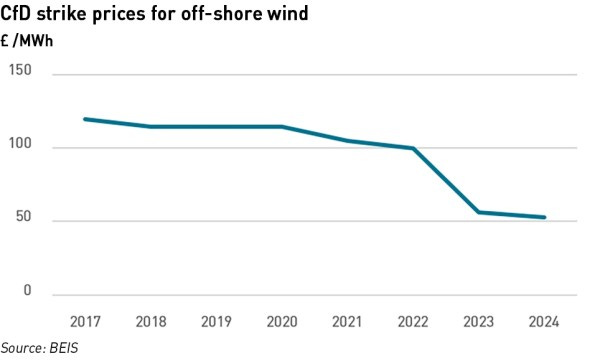

Renewables advocates point to declining Contracts for Difference (“CfD”) strike prices as evidence the costs of renewables are falling. It is certainly a fact that CfD prices have been falling, but it is less easy to understand why. It is also reasonable to question why, after 20 years, subsidies are still required – 20 years should be long enough for a technology to mature to a level where subsidies are not needed, so perhaps the need for CfDs at all for technologies such as off-shore wind should be scrutinised.

I have previously referenced the work of Professor Gordon Hughes at the University of Edinburgh which shows that the capex and opex costs of offshore wind are not falling, contrary to the popular narrative that they are. I have also validated his work with my own research – most large UK wind projects are incorporated as SPVs and as such their accounts are publicly available at Companies House. These accounts show, for anyone with the patience to go through them, that the much vaunted price reductions are not happening in practice.

“The actual costs of onshore and offshore wind generation have not fallen significantly over the last two decades and there is little prospect that they will fall significantly in the next five or even ten years… Far from falling, the actual capital costs per MW of capacity to build new wind farms increased substantially from 2002 to about 2015 and have, at best, remained constant since then…the operating costs per MW of new capacity have increased significantly for both onshore and offshore wind farms over the last two decades,”

– Professor Gordon Hughes, University of EdinburghIt is difficult to square this with falling CfD auction prices, but the CfD only needs to support cashflows for debt repayment – it is likely that once the subsidies expire many schemes will be uneconomic unless high power prices persist, which undermines the “renewables provide low cost energy” arguments.

Hughes postulates that three factors may explain falling CfD prices: the dominance of large, often state-controlled companies in the off-shore wind sector that can deploy large cash flows from existing businesses, and which are under little pressure to return cash to either customers or shareholders; the operators may expect to be able to sell a large portion of their shares in the projects to over-optimistic investors while projects also rely heavily on debt provided by equally naïve lenders; and operators / financial investors may expect to be bailed out, since once the financial consequences of the underlying economics become undeniable there will be pressure to pass the full costs of these projects to either electricity consumers or taxpayers.

I’m doubtful that operators or investors are thinking that deeply…I suspect that as long as they can get deals done they are happy to buy into the falling costs narrative, particularly since the day of reckoning when the subsidy schemes expire is 15 years away at which point the individuals concerned will most likely have moved on.

In fact there is now a consensus that rising prices of materials such as steel and copper will have to be passed on to customers, driven in part by the war in Ukraine, so all new infrastructure investments including renewable generation will be subject to higher costs and possible supply chain disruptions. This may well change bidding behaviour in future CfD auctions, reversing the downwards trend, while some energy companies have already booked impairments on renewables projects under construction.

Renewables do not provide cheap electricity

Renewables supporters also claim that the energy they provide is cheap, an argument which has widespread appeal since it is clear to everyone that wind and sunshine are free. Unfortunately, this fact isn’t that relevant when considering the cost of renewable generation, because what matters is the cost of reliable electricity which includes the electricity that has to be provided when it isn’t windy or sunny.

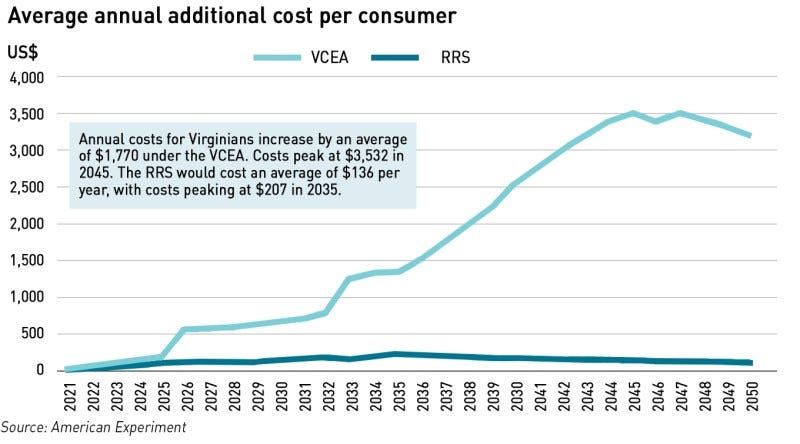

This study published in February by US-based think tank American Experiment highlights to costs of renewable generation to end users. This study assesses how the Virginia Clean Economy Act (“VCEA”) would increase costs for consumers and make the grid more fragile. It also assesses an alternative scenario, the Reliable Resource Scenario (“RRS”), where reliability and affordability are prioritised.

“Offshore wind dramatically increases the cost of providing the electricity Virginians rely upon. This energy source will cost $154 per megawatt-hour (MWh) when the often-hidden transmission costs, property taxes, utility returns, and battery storage costs are accounted for. The VCEA will reduce the reliability of the grid by making the state more reliant upon weather-dependent energy sources like wind and solar, and energy imports from other states. This is the same strategy California has pursued, with unenviable results.”

The VCEA proposal would see an electricity mix free from fossil fuels by 2050, with around 30% of electricity coming from nuclear and hydro, 15% from imports and the rest from intermittent renewables and batteries. The RRS alternative has a similar amount of nuclear, hydro and imports, but has half of electricity coming from natural gas.

The conclusions are not specific to Virginia, they are generically true for all markets where fossil fuel based generation is being displaced by subsidised intermittent renewables. The study points out that the LCOE (Levelised Cost of Energy, which reflects the cost of generating electricity from different types of power plants, on a per-unit of electricity basis over an assumed lifetime and quantity of electricity generated by the plant) for renewables is higher than for fossil fuel generation once the costs of backing-up their intermittency is included, something many analyses including the ones used by BEIS, fail to include. Cost comparisons should reflect the costs of delivering reliable electricity to end users, ie the cost to meet demand, so ignoring intermittency invalidates these comparisons.

The key inputs in the BEIS LCOE calculations are pre-development costs, construction costs, fixed and variable operations and maintenance costs, the load factor and the operating period. So while the costs are adjusted to reflect periods of intermittency they do not include the cost of the technology required to fill the gap. This means that comparisons with conventional generation are flawed since conventional generation will provide electricity whenever it is needed and does not depend on unpredictable external factors such as the weather.

Another recent study by the University of Nottingham has shown that a wide-scale deployment of small-scale renewables can reduce grid resilience and may lead to failures. They studied smart meter data to track changes in grid composition over time and found resilience varies over the course of a day and that a high uptake of solar PV can increase the vulnerability of the grid. They also found that the addition of domestic batteries, while supporting consumer self-sufficiency, does not significantly reduce these risks.

“The increasing proliferation of small, intermittent renewable power sources is causing a rapid change in the structure and composition of the power grid. Indeed, the grid’s effective structure can change over the course of a day as consumers and small-scale generators come on- and off-line. Using data from smart meters in UK households we tracked how grid composition varies over time. We then used a dynamical model to assess how these changes impact the resilience of power grids to catastrophic failures. We found that resilience varies over the course of a day and that a high uptake of solar panels can leave the grid more susceptible to failure,”

– Oliver Smith, researcher at the University of NottinghamThere are just over a million small-scale domestic solar systems in the UK. They are low-output, intermittent and tend to be distributed across power grids in large numbers. The power they supply to the grid in export mode is unpredictable with generators going on and off-line intermittently – households adopt the role of consumers or producers, as usage and weather conditions vary both throughout the day and across the year. The Nottingham analysis shows that microgrids spend most of their time operating in the least favourable conditions for grid resilience, across all ranges of PV uptake due to a supply-demand discrepancy. This means microgrids are alternately dominated by either consumption or generation and are therefore unable to exploit the robustness advantages that increased distribution would be expected to provide.

Domestic batteries are designed to support consumers in being self-sufficient, and are rarely configured to export to the grid in a domestic setting, meaning they do little to mitigate the effects that domestic solar has on the grid. While new technologies such as V2G (vehicle-to-grid) services may help to meet this need, appropriate power control systems will be essential to capturing this potential benefit, as well as a willingness on the part of consumers to relinquish control of their assets to third parties.

End user prices have risen steadily over the past 20 years, in line with the subsidisation of renewable generation. While correlation does not necessarily indicate causation, no such trend is evident in wholesale prices, and with the increased deployment of renewable generation, consumers have faced not only the costs of subsidies, but also the costs of building new grid infrastructure to connect these renewables, as well as the costs of balancing their intermittency and providing back-up for when wind drops or there is no sun (it is depressing how often people need to be reminded that the sun sets before the winter evening peak, meaning solar contributes absolutely nothing to the periods of highest grid demand).

The past few months have seen a significant increase in wholesale prices. When added to the other cost increases, this is making electricity increasingly unaffordable for many consumers. As fuel poverty rises, it is time to recognise that renewable electricity is not cheap. This does not necessarily mean it is wrong to develop it, but it is time to be honest about the costs, and consider pausing new subsidies while issues of affordability are addressed, particularly as the cost of new projects is set to rise.

As John D commented on Kathryn’s article:

“Finally, a rounded view of the real cost of renewables. The dispatchability component is critical and conveniently left out.”

John Bowen commented:

“Well done for blowing a hole in the Renewable craze and reminded the politicians the Sun and Wind only produce a volatile, unpredictable output. In the case of the UK we are fortunate to still have CCGT (Gas) stations which mirror the Renewables and make-up the shortfall on a daily if not hourly basis.”